Trends and challenges in prime residential markets 2024

2024 Outlook: trends and challenges in prime residential markets

At the beginning of 2024, the evolution of luxury residential real estate markets remains a major point of interest. In this regard, an in-depth analysis conducted by our partner Savills provides crucial insights into the trends and dynamics shaping these markets globally.

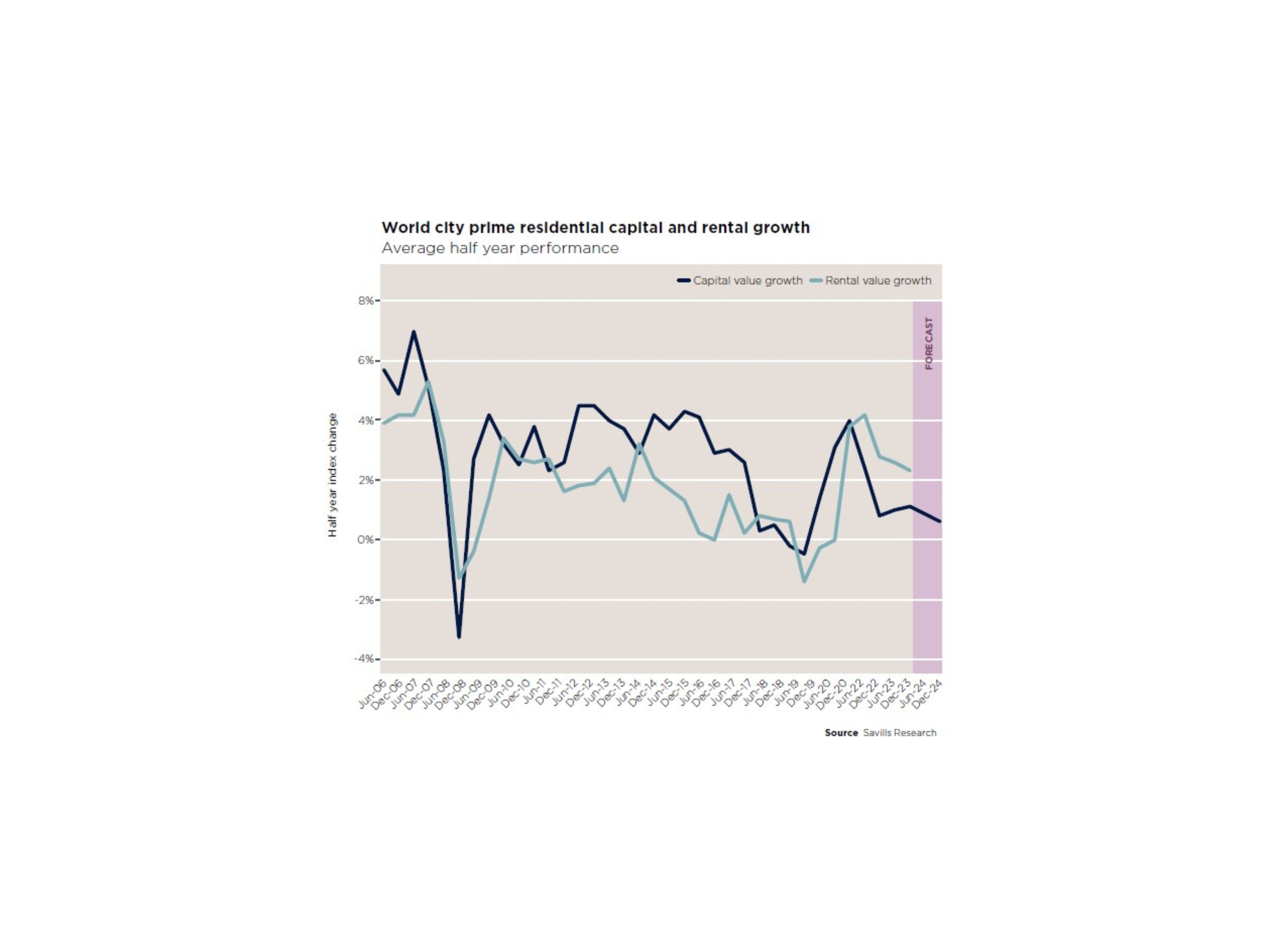

Analysis of 2023: inflationary pressures and subdued growth

According to the Savills report, the primary residential markets worldwide faced economic challenges and difficult market conditions in 2023. These factors contributed to moderate yet resilient growth performances in the luxury residential sectors. Despite economic uncertainty and higher interest rates, property prices and rents experienced growth, although this trend is expected to slow down in 2024.

Increase in rental prices exceeding that of real estate

In 2023, a notable trend was the significant increase in luxury rental prices, surpassing that of property values (+5.1%). This dynamic was primarily driven by the scarcity of supply in many high-end rental markets, coupled with increasing demand. For instance, Lisbon stood out with a noteworthy rise in rents (averaging +22%), highlighting the challenges associated with the shortage of available rental housing in certain areas.

Outlook for 2024: mitigation of inflationary pressures

While we are well into 2024, economists, policymakers, and market stakeholders agree on a gradual mitigation of inflationary pressures. This should result in a "wait and see" environment for buyers and sellers, characterized by sustained high-interest rates over an extended period and moderate global economic growth. Despite these conditions, prime residential markets are expected to maintain their resilience, with rental growth once again outpacing that of property prices.

Challenges and opportunities ahead

Global economic challenges, including demographic changes, urbanization, and political uncertainty, will continue to shape prime residential markets in 2024. However, there are also opportunities, including the potential to stimulate activity in prime property markets through potential central bank interest rate cuts.

Analysis of the luxury real estate market in the Lake Geneva region

Lake Geneva market, covered by Luxury Places, is not immune to major international trends. The pandemic years, characterized by negative interest rates and early signs of inflation over the past two years, have greatly favored the prime real estate segment. Since 2021, the number of transactions has doubled compared to 2019, in 2022, we observed the beginning of a decline in transaction volumes, although prices continue to rise. In 2023, this downward trend persisted, bringing transaction levels back to those of 2019, with price stabilization that has not been impacted by these years of strong increases.

In 2024, caution is warranted. The residential market on Lake Geneva is largely influenced by a local clientele, which necessarily reduces the potential pool of buyers in the face of these impressive statistics. We anticipate stabilization, or even a slight correction in prices for certain types of properties. Foreign demand remains uncertain, and its evolution will be crucial for any potential market rebound.

Would you like to learn more? Read the full research "Savills Prime Residential Index: World Cities"

Source: Savills World Research - Savills Prime Residential Index: World Cities, "Turbulent times", February 2024