Aline Monnier

Anna Gallier-Runnqvist

Charlotte Le Chanu

David Colle

Denise Gomes

Florian Dupont

Gaia Prost

Gwenaël Iynedjian

Marc Dénéréaz

Sandrine Fremond

Solène Saint-Salvi

Property to be completely renovated with large plot and view in Dully

Exceptional plot in lake front located in Rolle

EKÔ SAVANNAH - Resort, Club & Conciergerie - Tamarin, Mauritius

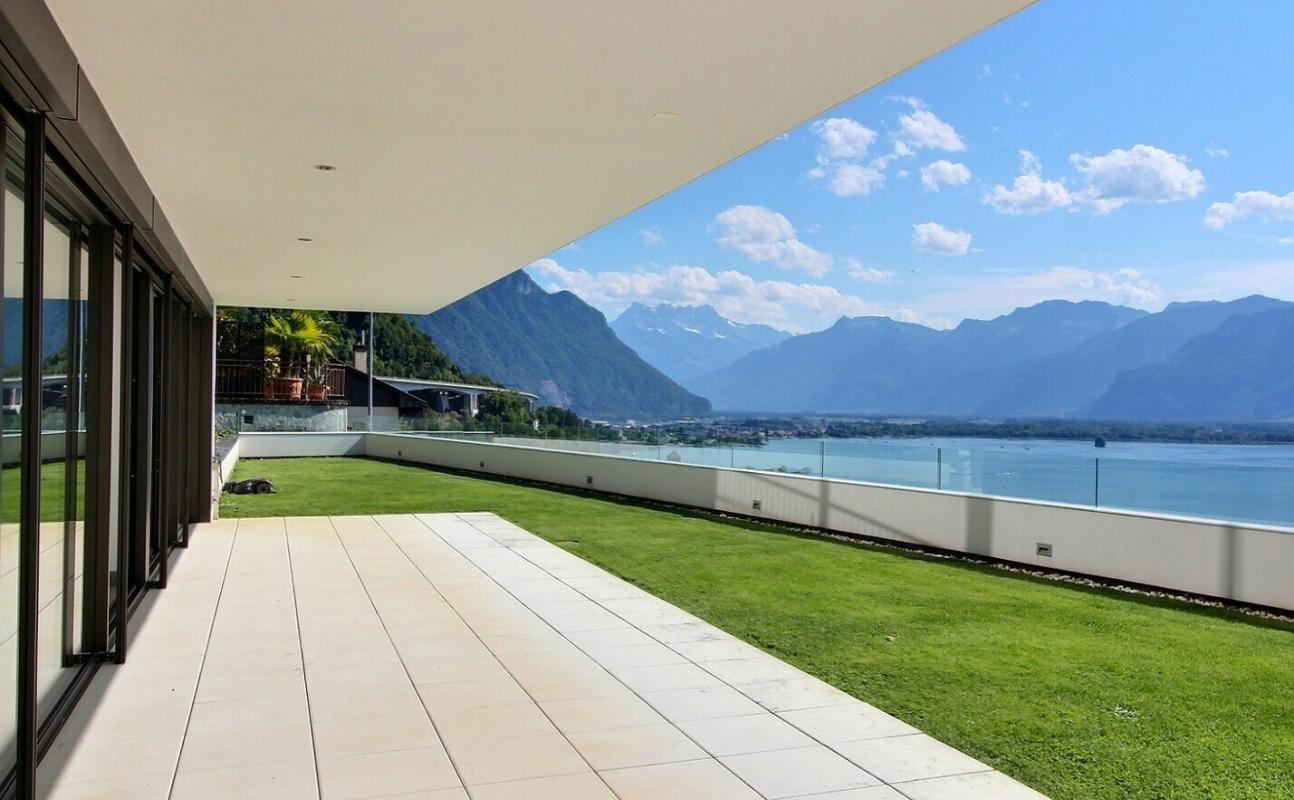

Wonderful and modern flat with panoramic view in Montreux

Beautiful 7.5 room duplex penthouse very close to the lake ,St Sulpice

Beautiful flat close to the lake with panoramic view in Montreux

Sumptuous Estate of the 18th century, Cologny

Wonderful and renovated flat with view on the lake in Clarens

Superb contemporary villa, infinity swimming pool, lake view, Vésenaz

Trends and challenges in prime residential markets 2024

2024 Outlook: trends and challenges in prime residential markets

At the beginning of 2024, the evolution of luxury residential real estate markets remains a major point of interest. In this regard, an in-depth analysis conducted by our partner Savills provides crucial insights into the trends and dynamics shaping these markets globally.

Analysis of 2023: inflationary pressures and subdued growth

According to the Savills report, the primary residential markets worldwide faced economic challenges and difficult market conditions in 2023. These factors contributed to moderate yet resilient growth performances in the luxury residential sectors. Despite economic uncertainty and higher interest rates, property prices and rents experienced growth, although this trend is expected to slow down in 2024.

Increase in rental prices exceeding that of real estate

In 2023, a notable trend was the significant increase in luxury rental prices, surpassing that of property values (+5.1%). This dynamic was primarily driven by the scarcity of supply in many high-end rental markets, coupled with increasing demand. For instance, Lisbon stood out with a noteworthy rise in rents (averaging +22%), highlighting the challenges associated with the shortage of available rental housing in certain areas.

Outlook for 2024: mitigation of inflationary pressures

While we are well into 2024, economists, policymakers, and market stakeholders agree on a gradual mitigation of inflationary pressures. This should result in a "wait and see" environment for buyers and sellers, characterized by sustained high-interest rates over an extended period and moderate global economic growth. Despite these conditions, prime residential markets are expected to maintain their resilience, with rental growth once again outpacing that of property prices.

Challenges and opportunities ahead

Global economic challenges, including demographic changes, urbanization, and political uncertainty, will continue to shape prime residential markets in 2024. However, there are also opportunities, including the potential to stimulate activity in prime property markets through potential central bank interest rate cuts.

Analysis of the luxury real estate market in the Lake Geneva region

Lake Geneva market, covered by Luxury Places, is not immune to major international trends. The pandemic years, characterized by negative interest rates and early signs of inflation over the past two years, have greatly favored the prime real estate segment. Since 2021, the number of transactions has doubled compared to 2019, in 2022, we observed the beginning of a decline in transaction volumes, although prices continue to rise. In 2023, this downward trend persisted, bringing transaction levels back to those of 2019, with price stabilization that has not been impacted by these years of strong increases.

In 2024, caution is warranted. The residential market on Lake Geneva is largely influenced by a local clientele, which necessarily reduces the potential pool of buyers in the face of these impressive statistics. We anticipate stabilization, or even a slight correction in prices for certain types of properties. Foreign demand remains uncertain, and its evolution will be crucial for any potential market rebound.

Would you like to learn more? Read the full research "Savills Prime Residential Index: World Cities"

Source: Savills World Research - Savills Prime Residential Index: World Cities, "Turbulent times", February 2024

Savills Ski Report

The 18th annual Savills Ski Report examines the pricing, resilience, retail, and rental markets of the world’s top ski resorts and offers our market outlook for some of the most popular global resorts.

Twelve months ago, our crystal ball was crystal clear. After two years of vertiginous price growth in mountain resorts across Europe and North America, it was apparent that the market could not sustain continued increases of 15% (or more, in some cases) per annum. Our prediction that the market would split into two tiers – with a flattening of the curve at the mid to lower end, and a continuation of price growth at the ultra-prime end – duly transpired.

Fast forward to autumn 2023 and our crystal ball is now a little hazier. In September 2023, for the first time in 15 meetings, the Bank of England chose not to raise interest rates. This pause for breath is likely to be emulated by both the Federal Reserve and European Central Bank in the coming months, as they too reflect upon whether fiscal tightening has the desired effect of lowering embedded inflation.

One thing is clear: higher interest rates have unquestionably deterred some potential buyers in the Alps. ’Investor’ type buyers can no longer generate positive returns if they have more than a 50% loan-to-value mortgage. Even if they wanted to, British buyers, post-Brexit, still find it virtually impossible to find a mortgage product in France. Fortunately for developers and private sellers, there are plenty of other domestic and European buyers to help sustain demand.

At higher price levels, in excess of €/CHF 3 million, the mortgage market is less of a factor. High-net-worth buyers are typically less reliant on debt and would ordinarily only use a bank loan to deploy capital elsewhere, or as a fiscal instrument to reduce wealth tax. Combined with continued shortages of alpine property across all price levels, ultra-prime resorts have held strong, with only 20% experiencing price falls.

With government elections both sides of the Atlantic in 2024, inflationary pressures and continuing geopolitical unrest, the uncertainty in the global economy prevails. Although the ski property market continues to defy such external influences, predicting the trends over the next 12 months is harder.

Meanwhile, our 18th annual Ski Report takes a closer look at the prime and ultra-prime prices of the world’s top ski resorts and offers our market outlook for some of the most popular. We also consider the growth of luxury retail brands in the world’s leading ski resorts and publish our perennial Savills Ski Resilience Index, where there have been some interesting changes at the top. We hope very much that you enjoy reading the report and remain cautiously optimistic for the forthcoming season.