Savills Global Market Sentiment Survey

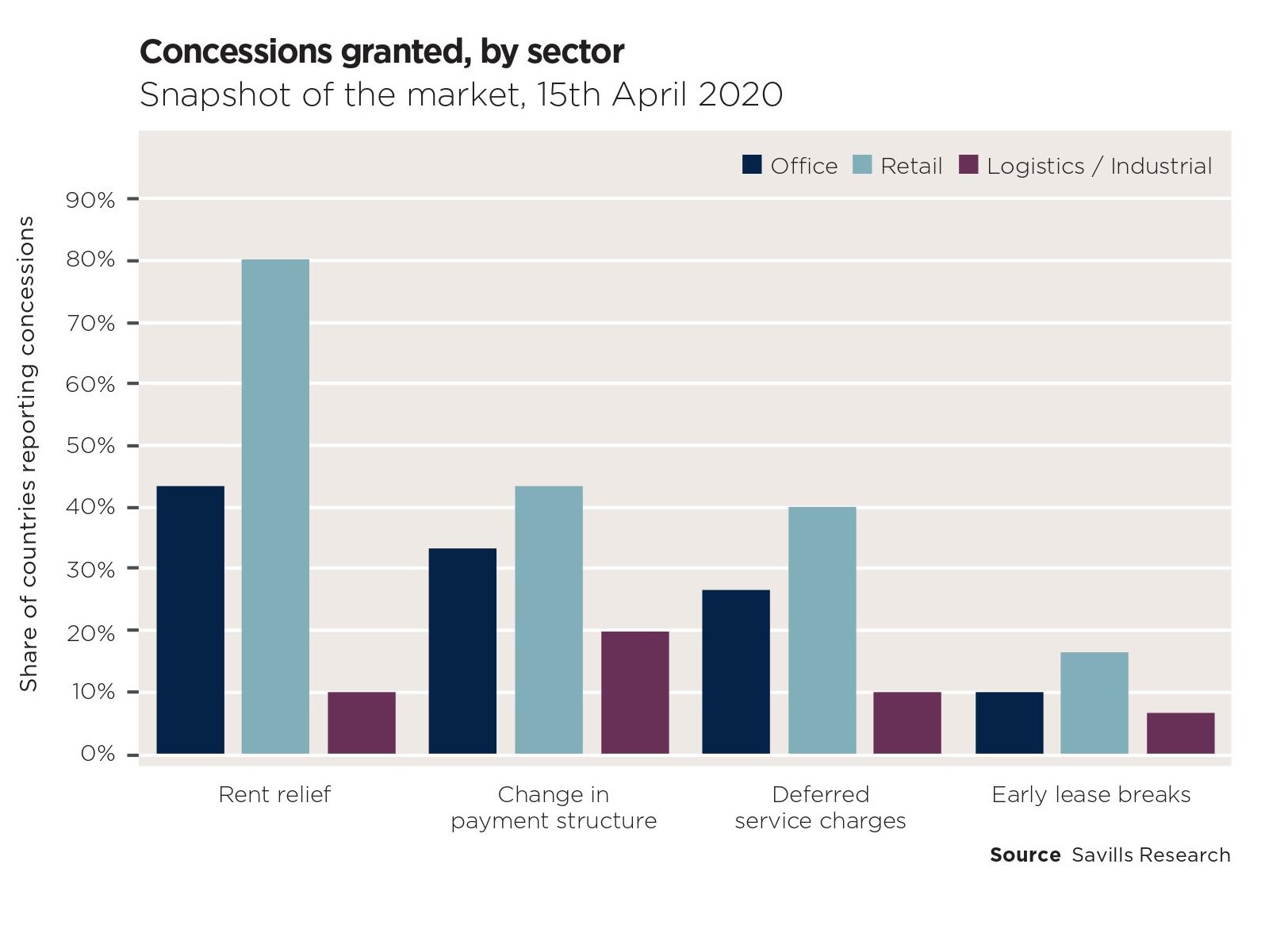

Concessions support the occupier markets, some early green shoots from China

Since we last conducted this survey at the end of March, the number of Covid-19 cases around the globe has more than doubled. But as many countries have reached peaks in the numbers of new infections, some clarity is emerging. Focus is now turning to ending the lockdowns, and in a few countries some nonessential sectors have reopened.

Some 29% of countries surveyed reported market sentiment to be ‘neutral’, 52% ‘slightly negative’ and only 16% ‘negative’. Sentiment in China is now ‘slightly positive’. China has seen some real estate activity resume as infection rates have been brought under control. South Korea and Vietnam, also benefitting from rapid decreases in infection levels, both reported ‘neutral’ market sentiment.

Here we provide a snapshot of how market conditions have changed since the end of March across all sectors and geographies based on our survey of Savills research heads in 31 global markets.

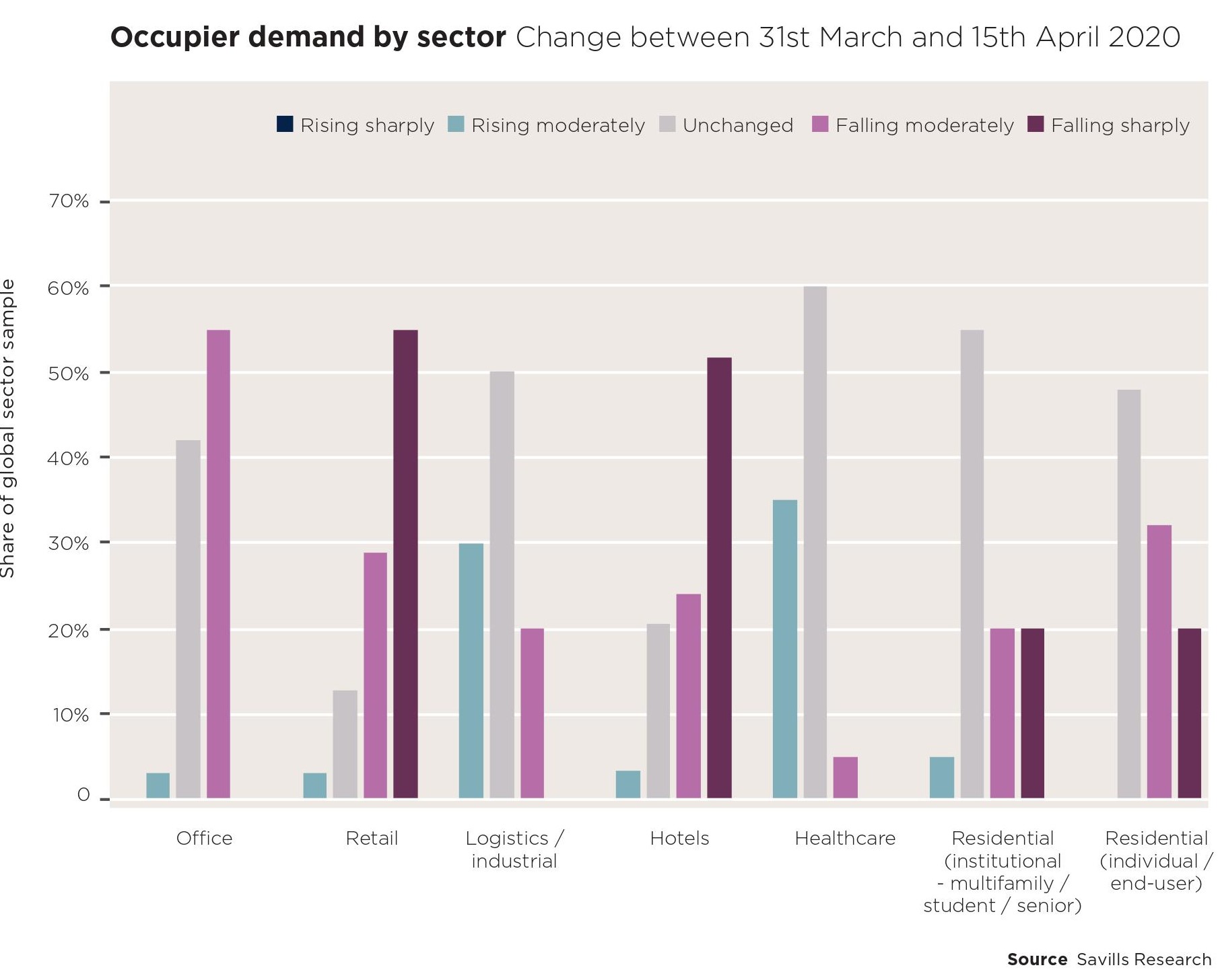

Occupier demand

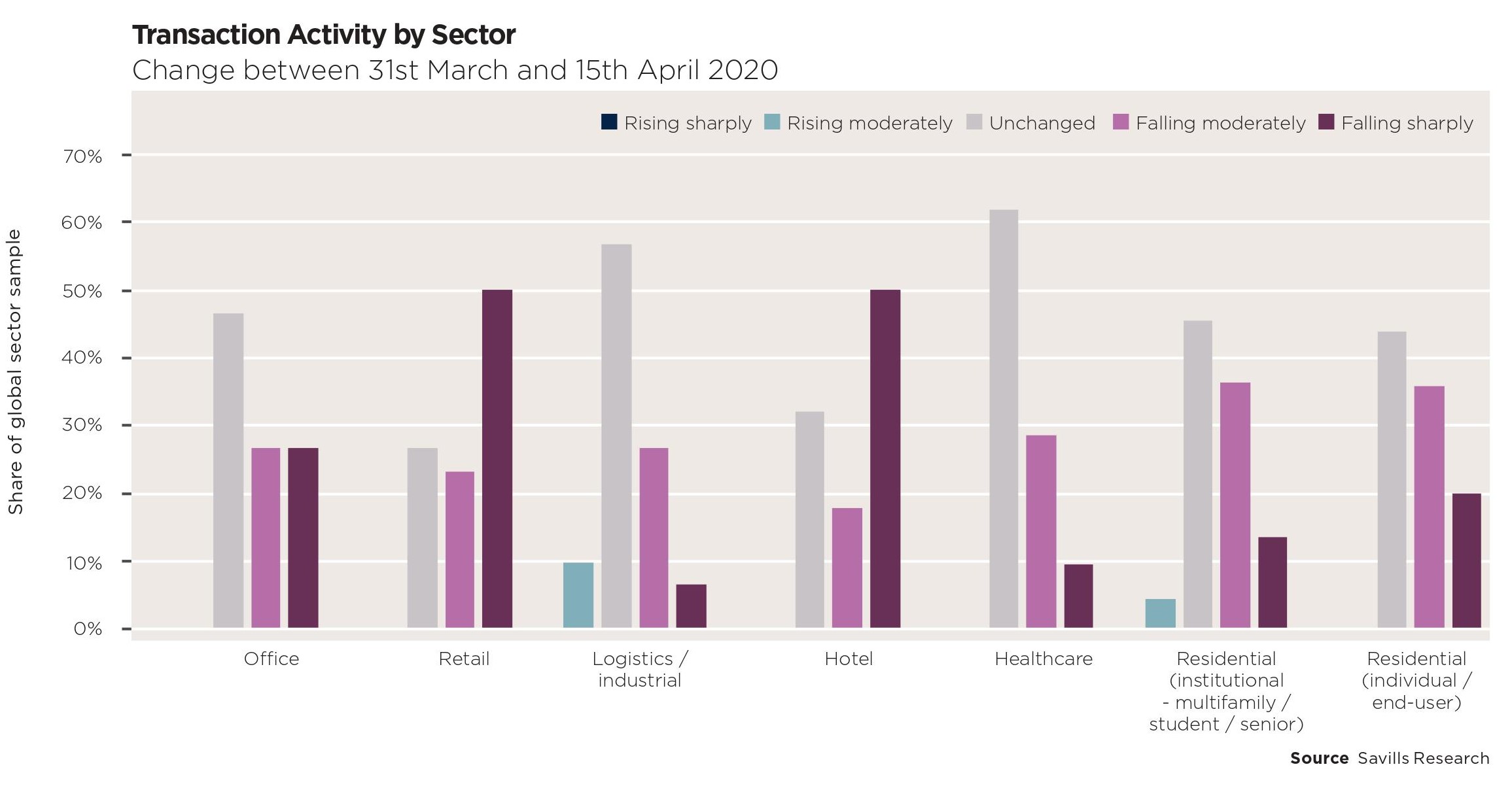

Occupiers had to dramatically adjust their behaviour to new ways of living and working in the wake of the pandemic. This altered occupier demand virtually overnight. But with early indications that many countries are now at the peak of the epidemic, signs of stability can be seen in some sectors. Demand for offices from occupiers is reported to be stable in 42% of countries, while 55% reported moderate falls in occupier demand. This is a significant improvement from the 70% that reported moderate falls at the end of March.

Supported by a surge of online retail sales, occupier demand in logistics was reported to be unchanged or rising modestly in more than 79% of countries. Only in the retail and hotel sectors has occupier demand continued to decline, reported to be falling sharply in more than half of countries.